How Does The Maine Homestead Exemption Work . The homestead exemption application is available at most municipalities or you may download the application on the homestead exemptions. The money you save will depend upon the tax rate for your town. The homestead exemption act provides a reduction of up to $25,000 in the value of your home for property tax purposes, according to the state revenue services. In maine, “the just value of $10,000 of the homestead of a permanent resident of this. You must check all three boxes to qualify for the maine homestead property tax. Check the appropriate box related to each question. Property taxes are based on the tax value of your home. What is maine's law on homestead exemption. The homestead exemption applies to real and personal property used as your residence in maine, including a house, mobile.

from yourrealtorforlifervictoriapeterson.com

In maine, “the just value of $10,000 of the homestead of a permanent resident of this. The homestead exemption act provides a reduction of up to $25,000 in the value of your home for property tax purposes, according to the state revenue services. You must check all three boxes to qualify for the maine homestead property tax. The homestead exemption application is available at most municipalities or you may download the application on the homestead exemptions. The homestead exemption applies to real and personal property used as your residence in maine, including a house, mobile. What is maine's law on homestead exemption. The money you save will depend upon the tax rate for your town. Property taxes are based on the tax value of your home. Check the appropriate box related to each question.

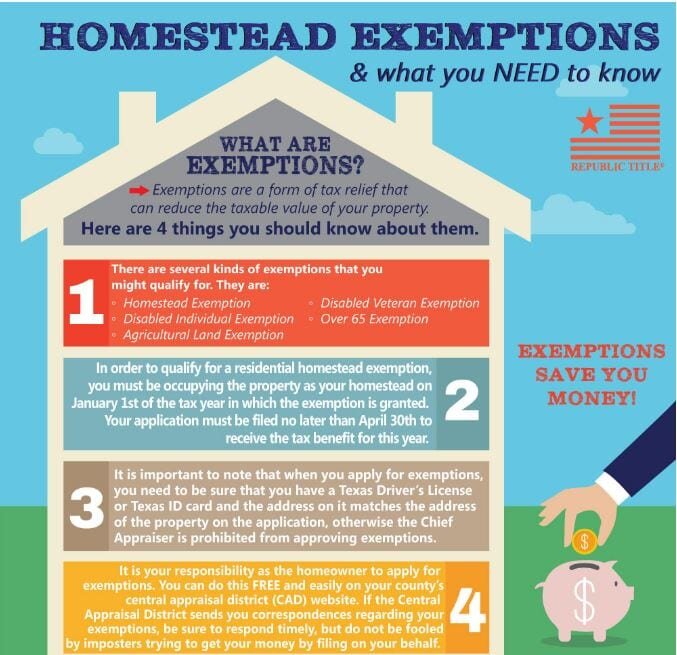

Homestead Exemptions & What You Need to Know — Rachael V. Peterson

How Does The Maine Homestead Exemption Work The homestead exemption applies to real and personal property used as your residence in maine, including a house, mobile. You must check all three boxes to qualify for the maine homestead property tax. What is maine's law on homestead exemption. The homestead exemption applies to real and personal property used as your residence in maine, including a house, mobile. Check the appropriate box related to each question. The money you save will depend upon the tax rate for your town. Property taxes are based on the tax value of your home. In maine, “the just value of $10,000 of the homestead of a permanent resident of this. The homestead exemption act provides a reduction of up to $25,000 in the value of your home for property tax purposes, according to the state revenue services. The homestead exemption application is available at most municipalities or you may download the application on the homestead exemptions.

From yourrealtorforlifervictoriapeterson.com

Homestead Exemptions & What You Need to Know — Rachael V. Peterson How Does The Maine Homestead Exemption Work Property taxes are based on the tax value of your home. In maine, “the just value of $10,000 of the homestead of a permanent resident of this. The homestead exemption application is available at most municipalities or you may download the application on the homestead exemptions. You must check all three boxes to qualify for the maine homestead property tax.. How Does The Maine Homestead Exemption Work.

From northclubrealestate.com

How Does Homestead Exemption Work? Should You Apply? How Does The Maine Homestead Exemption Work The homestead exemption application is available at most municipalities or you may download the application on the homestead exemptions. You must check all three boxes to qualify for the maine homestead property tax. What is maine's law on homestead exemption. The money you save will depend upon the tax rate for your town. In maine, “the just value of $10,000. How Does The Maine Homestead Exemption Work.

From brewermaine.gov

BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine How Does The Maine Homestead Exemption Work The homestead exemption act provides a reduction of up to $25,000 in the value of your home for property tax purposes, according to the state revenue services. Check the appropriate box related to each question. The homestead exemption applies to real and personal property used as your residence in maine, including a house, mobile. What is maine's law on homestead. How Does The Maine Homestead Exemption Work.

From www.exemptform.com

Harris County Homestead Exemption Form Printable Pdf Download How Does The Maine Homestead Exemption Work You must check all three boxes to qualify for the maine homestead property tax. The homestead exemption applies to real and personal property used as your residence in maine, including a house, mobile. In maine, “the just value of $10,000 of the homestead of a permanent resident of this. Check the appropriate box related to each question. Property taxes are. How Does The Maine Homestead Exemption Work.

From www.mansionglobal.com

How Does the U.S. Homestead Property Tax Exemption Work? Mansion Global How Does The Maine Homestead Exemption Work In maine, “the just value of $10,000 of the homestead of a permanent resident of this. Check the appropriate box related to each question. The homestead exemption applies to real and personal property used as your residence in maine, including a house, mobile. What is maine's law on homestead exemption. The money you save will depend upon the tax rate. How Does The Maine Homestead Exemption Work.

From www.templateroller.com

Maine Application for Maine Homestead Property Tax Exemption Fill Out How Does The Maine Homestead Exemption Work The homestead exemption act provides a reduction of up to $25,000 in the value of your home for property tax purposes, according to the state revenue services. In maine, “the just value of $10,000 of the homestead of a permanent resident of this. The homestead exemption application is available at most municipalities or you may download the application on the. How Does The Maine Homestead Exemption Work.

From www.templateroller.com

Maine Homestead Property Tax Exemption Application Fill Out, Sign How Does The Maine Homestead Exemption Work The homestead exemption applies to real and personal property used as your residence in maine, including a house, mobile. The homestead exemption act provides a reduction of up to $25,000 in the value of your home for property tax purposes, according to the state revenue services. Property taxes are based on the tax value of your home. The money you. How Does The Maine Homestead Exemption Work.

From www.mattcurtisrealestate.com

How does Homestead Exemption work in Madison County? How Does The Maine Homestead Exemption Work Property taxes are based on the tax value of your home. The homestead exemption application is available at most municipalities or you may download the application on the homestead exemptions. The homestead exemption applies to real and personal property used as your residence in maine, including a house, mobile. What is maine's law on homestead exemption. In maine, “the just. How Does The Maine Homestead Exemption Work.

From penobscotfa.com

Real Estate Taxes & The Maine Homestead Exemption Penobscot Financial How Does The Maine Homestead Exemption Work You must check all three boxes to qualify for the maine homestead property tax. The homestead exemption application is available at most municipalities or you may download the application on the homestead exemptions. The homestead exemption applies to real and personal property used as your residence in maine, including a house, mobile. In maine, “the just value of $10,000 of. How Does The Maine Homestead Exemption Work.

From www.linkedin.com

Q How Does the Homestead Exemption Work? How Does The Maine Homestead Exemption Work Check the appropriate box related to each question. What is maine's law on homestead exemption. The homestead exemption applies to real and personal property used as your residence in maine, including a house, mobile. The homestead exemption act provides a reduction of up to $25,000 in the value of your home for property tax purposes, according to the state revenue. How Does The Maine Homestead Exemption Work.

From www.newscentermaine.com

Maine homestead exemption brings 100 bonus How Does The Maine Homestead Exemption Work Check the appropriate box related to each question. The homestead exemption application is available at most municipalities or you may download the application on the homestead exemptions. The homestead exemption act provides a reduction of up to $25,000 in the value of your home for property tax purposes, according to the state revenue services. The homestead exemption applies to real. How Does The Maine Homestead Exemption Work.

From usdaloanpro.com

How does the Florida Homestead Exemption apply if you purchase a home How Does The Maine Homestead Exemption Work The homestead exemption application is available at most municipalities or you may download the application on the homestead exemptions. In maine, “the just value of $10,000 of the homestead of a permanent resident of this. The money you save will depend upon the tax rate for your town. Property taxes are based on the tax value of your home. The. How Does The Maine Homestead Exemption Work.

From www.templateroller.com

Maine Application for Maine Homestead Property Tax Exemption for How Does The Maine Homestead Exemption Work The money you save will depend upon the tax rate for your town. Property taxes are based on the tax value of your home. The homestead exemption application is available at most municipalities or you may download the application on the homestead exemptions. In maine, “the just value of $10,000 of the homestead of a permanent resident of this. The. How Does The Maine Homestead Exemption Work.

From www.exemptform.com

County Indiana Homestead Exemption Form How Does The Maine Homestead Exemption Work The homestead exemption act provides a reduction of up to $25,000 in the value of your home for property tax purposes, according to the state revenue services. In maine, “the just value of $10,000 of the homestead of a permanent resident of this. Check the appropriate box related to each question. Property taxes are based on the tax value of. How Does The Maine Homestead Exemption Work.

From www.exemptform.com

How Do I File For Homestead Exemption In Osceola County PROFRTY How Does The Maine Homestead Exemption Work The homestead exemption act provides a reduction of up to $25,000 in the value of your home for property tax purposes, according to the state revenue services. The homestead exemption applies to real and personal property used as your residence in maine, including a house, mobile. What is maine's law on homestead exemption. Property taxes are based on the tax. How Does The Maine Homestead Exemption Work.

From orchard.com

How a Homestead Exemption Can Save You Taxes Orchard How Does The Maine Homestead Exemption Work What is maine's law on homestead exemption. Check the appropriate box related to each question. Property taxes are based on the tax value of your home. The homestead exemption act provides a reduction of up to $25,000 in the value of your home for property tax purposes, according to the state revenue services. In maine, “the just value of $10,000. How Does The Maine Homestead Exemption Work.

From nammatech.com

Florida Homestead Exemption Application Guide Who is Eligible? How Does The Maine Homestead Exemption Work In maine, “the just value of $10,000 of the homestead of a permanent resident of this. Property taxes are based on the tax value of your home. Check the appropriate box related to each question. What is maine's law on homestead exemption. You must check all three boxes to qualify for the maine homestead property tax. The homestead exemption applies. How Does The Maine Homestead Exemption Work.

From itrfoundation.org

Credit Versus Exemption in Homestead Property Tax Relief ITR Foundation How Does The Maine Homestead Exemption Work You must check all three boxes to qualify for the maine homestead property tax. Property taxes are based on the tax value of your home. Check the appropriate box related to each question. In maine, “the just value of $10,000 of the homestead of a permanent resident of this. The homestead exemption act provides a reduction of up to $25,000. How Does The Maine Homestead Exemption Work.